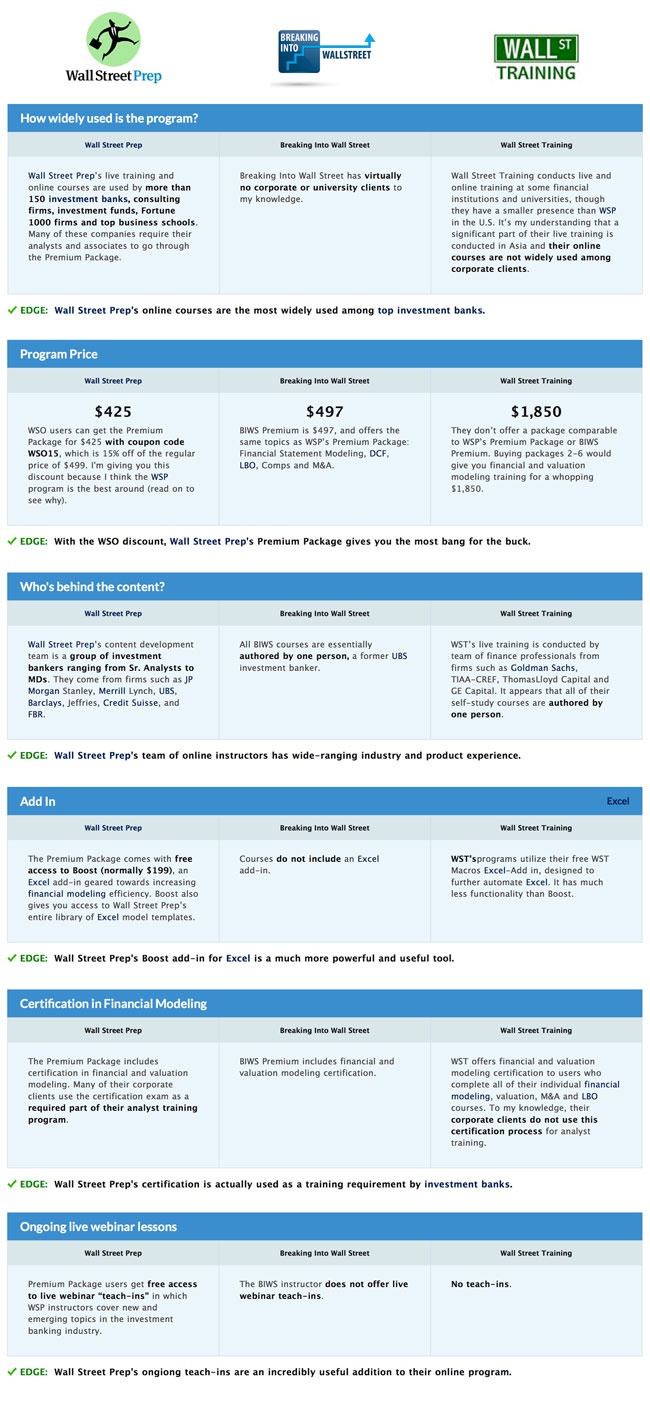

Because every balance sheet follows a specific formula and by definition must balance investors need some ways to analyze what a balance sheet is really saying.

Balance sheet wall street oasis is important.

Definition balance sheet vs.

Two ratios that can be determined from the balance sheet are a company s debt to equity ratio and their acid test ratio.

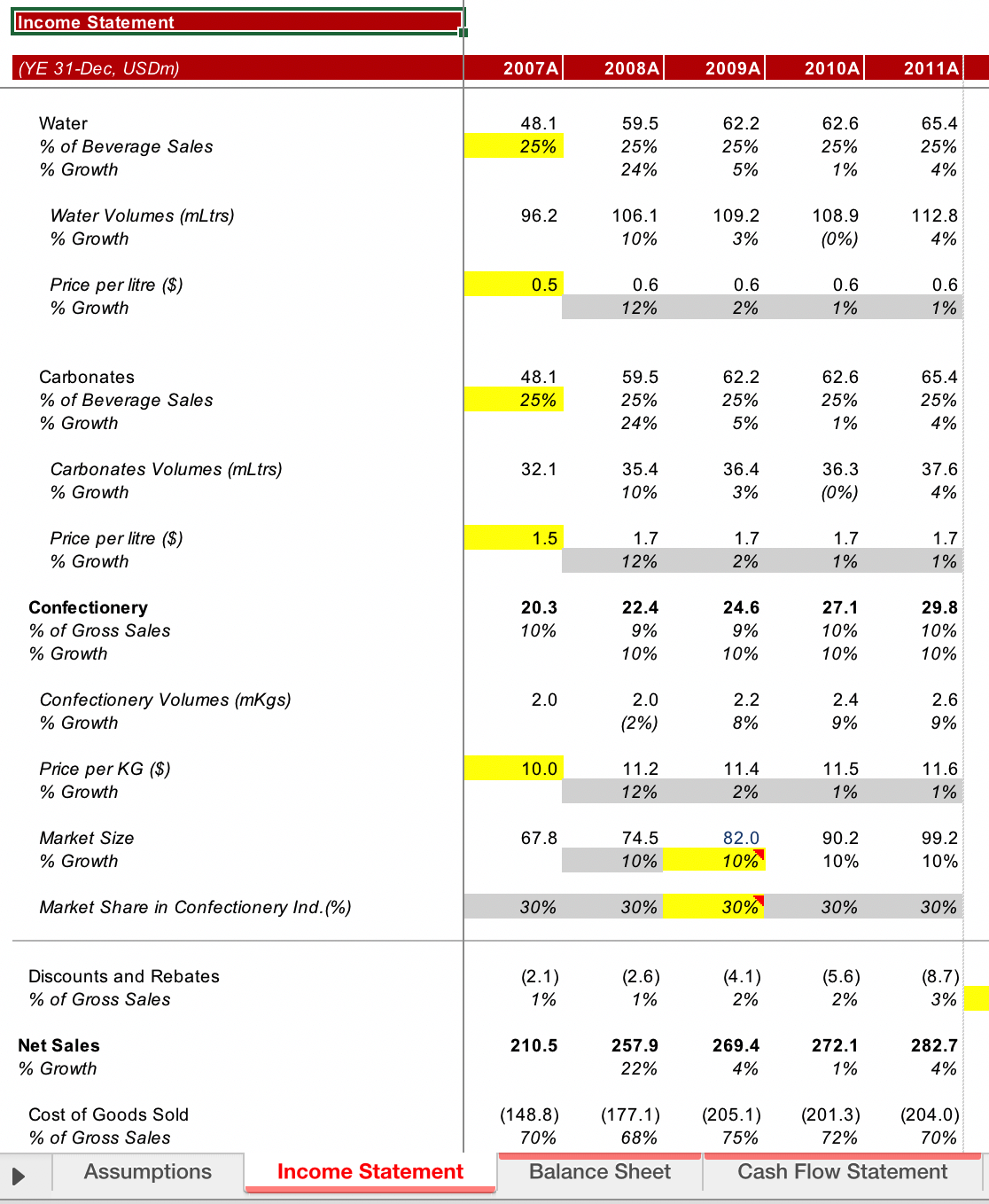

Based on analyst research and management guidance we have completed the company s income statement projections including revenues operating expenses interest expense and taxes all the way down to the company s net income.

Doing so will enable an individual to comprehend the nitty gritty.

Imagine that we are tasked with building a 3 statement statement model for apple.

The first entry would be.

Now it s time to turn to the balance she.

Consolidated balance sheet summarizes the financial affairs of parent subsidiary company.

Balance sheet projections exercise.

Please note that the entry is being recorded in the journal of the payee meaning who is entering the notes on the balance sheet meaning the customer.

Additional analysis that comes from the balance sheet.

A balance sheet is one of the three financial statements that are used to value a company and to show what it owns or owes.

The balance sheet lists all assets liabilities and shareholder s equity attributed to the company.

It is always a snapshot of one point in time.

It is important to understand the journal entries for notes payable.

Assets what the company owns or is owed liabilities any money the company.